Health Care Prices

Real data, real prices, real transparency on the cost of

health care

Real data, real prices, real transparency on the cost of

health care

This tool shows average price data for bundles of health services to help you better understand the cost of care in your area. Start by searching for a condition or service, or explore the most common bundles below.

Common Bundles

Common Bundles

Click “Browse all” to see more.

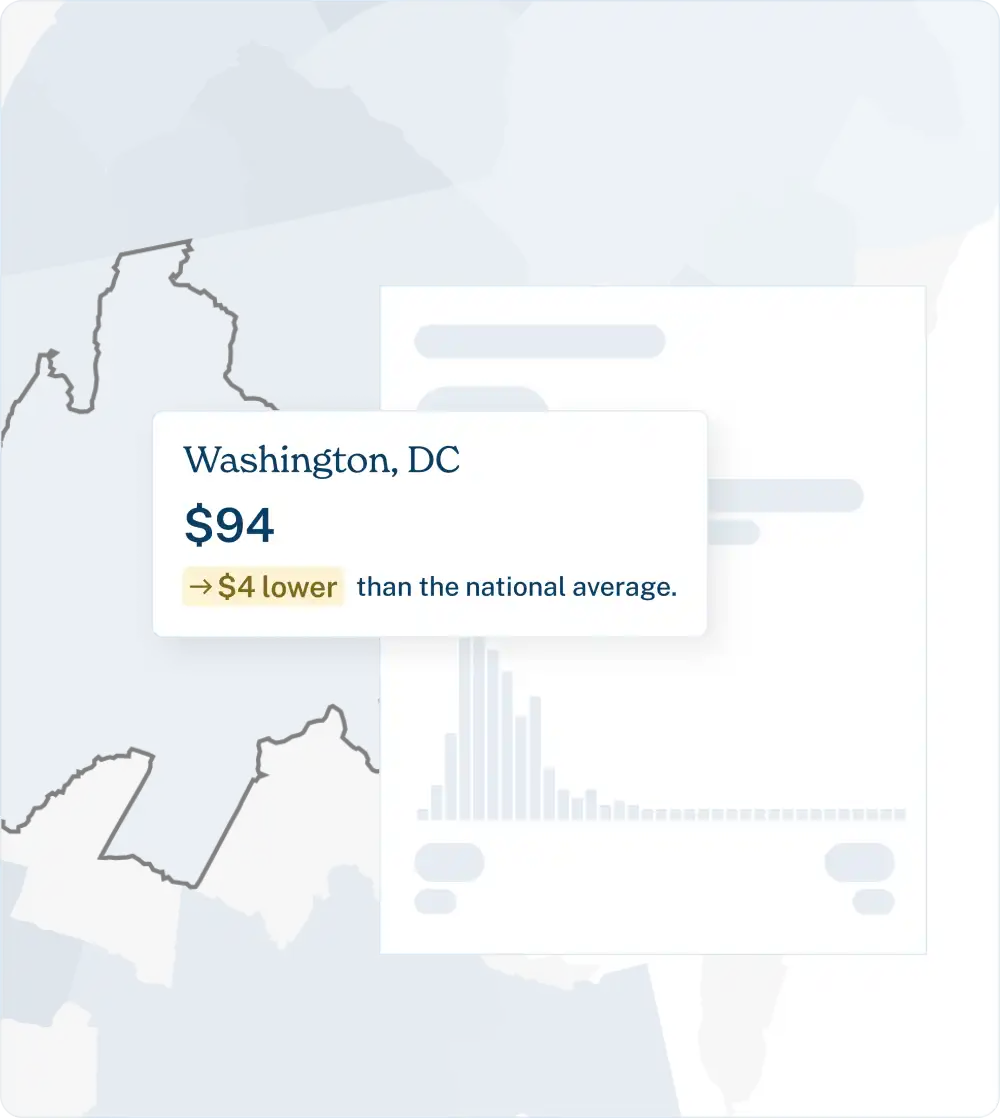

Explore health care prices in your city

Choose from nearly 400 bundles in our health care price toolkit. Whether you need a knee replacement, are giving birth, or scheduling an x-ray, we’ll show you the typical price for your city.

Find a bundle

Or compare prices nationwide

Discover how health care prices vary across hundreds of U.S. cities. Just select a bundle and your insurance type to get started.

Compare

Our mission

Our mission

Shed light on what consumers spend on health care

Help consumers benchmark their Explanation of Benefits

Prepare consumers to shop around for health care

The Health Care Price Toolkit uses real data from the Health Care Cost Institute that includes payments to hospitals and providers.

The Health Care Price Toolkit uses real data from the Health Care Cost Institute that includes payments to hospitals and providers.

The data contained in this website come from two sources: HCCI’s multi-payer claims dataset and data from Traditional Medicare. Altogether, our datasets include billions of health care claims, representing nearly 100 million people in all 50 states and D.C. All data are de-identified and HIPAA and antitrust compliant.

Frequently asked questions

Frequently asked questions

What is the Health Care Price Toolkit?

What is the Health Care Price Toolkit?

The Health Care “Price Toolkit” explains how health care services that are commonly associated with one another are priced. These groups of services, or bundles of services, range in complexity – from an office visit involving one or more regularly performed procedures, to a knee replacement that includes several “steps” leading up to and following the procedure.

What is Guroo?

What is Guroo?

GurooTM was a consumer price transparency website from the Health Care Cost Institute. This new Health Care Price Toolkit realigns the Guroo effort to help better inform efforts guided by federal price transparency regulations. This new tool uses the same datasets as the previous Guroo effort, in a more accessible format.

Why don’t you have the condition or treatment that I am searching for?

Why don’t you have the condition or treatment that I am searching for?

This website has price estimates for nearly 400 frequently searched conditions and services. We will periodically add to this toolkit, please reach out to us at guroo@healthcostinstitute.org to provide feedback and check back soon.

Why are the prices estimated?

Why are the prices estimated?

Actual health costs may vary based on your health status, insurance plan, health care provider and other factors.

The estimated prices here are estimated based on billions of historical payments to providers and hospitals. That historical information is a good indicator of what the price of a service might be, but actual health costs may vary based on your health status, insurance plan, health care provider and other factors.

How are the prices calculated?

How are the prices calculated?

The prices reported on this site are estimated from billions of records based on actual amounts paid by health insurers to health care providers. This includes the portion paid by the insurer as well as any patient deductible, coinsurance, or copayments owed by the patient. These prices do not account for any health insurance premium costs.

What is copayment, deductible, and co-insurance?

What is copayment, deductible, and co-insurance?

Copayment (copay)– A set fee that you pay at each doctor’s visit, or each time you fill a prescription. This amount usually ranges from $15 for your primary care to $50 or more for a specialist or emergency care. Prescription copays often vary and may depend on the cost (or Tier) of the medication. Not all insurance plans will have copays.

Deductible– This is the amount you must pay out-of-pocket to your provider before your coinsurance kicks in for coverage. Deductibles do not include copays.

Co-insurance– This is the amount you are responsible for paying after you’ve met your deductible. For example, if you have 80/20 coinsurance, this means that after your deductible is paid, you will be responsible for 20% of the costs, while your insurance is responsible for 80%.

Maximum out of pocket– The maximum out of pocket cost is a cap on the amount you will pay for covered services in a given year.

If I have health insurance, what does this information tell me?

If I have health insurance, what does this information tell me?

This information includes an overview of pricing and includes the amount your health insurance may cover. You will need to refer to your health insurance Summary of Benefits and Coverage to determine what may or may not be covered and what copayments, deductibles, or co-insurance you may be responsible for. You can compare the information in this site with your Explanation of Benefits (EOB) to better understand the cost of the care you have received.

If I don’t have health insurance, what does this information tell me?

If I don’t have health insurance, what does this information tell me?

All amounts seen would be paid out-of-pocket by you. Our prices reflect negotiated rates between providers and health insurance companies. The “cash” price without insurance may be higher or lower.

Does this website contain information about health care quality?

Does this website contain information about health care quality?

There are multiple ways to measure quality and determinations vary by procedure, location, and other factors. Quality is best addressed with provider information, and we do not include this broad range of information on this site. Our data is best used to give comparative pricing as a reference, and we encourage all consumers to do their research on how health care quality in a specific region compares across providers.

Where can I find more health care quality measures?

Where can I find more health care quality measures?